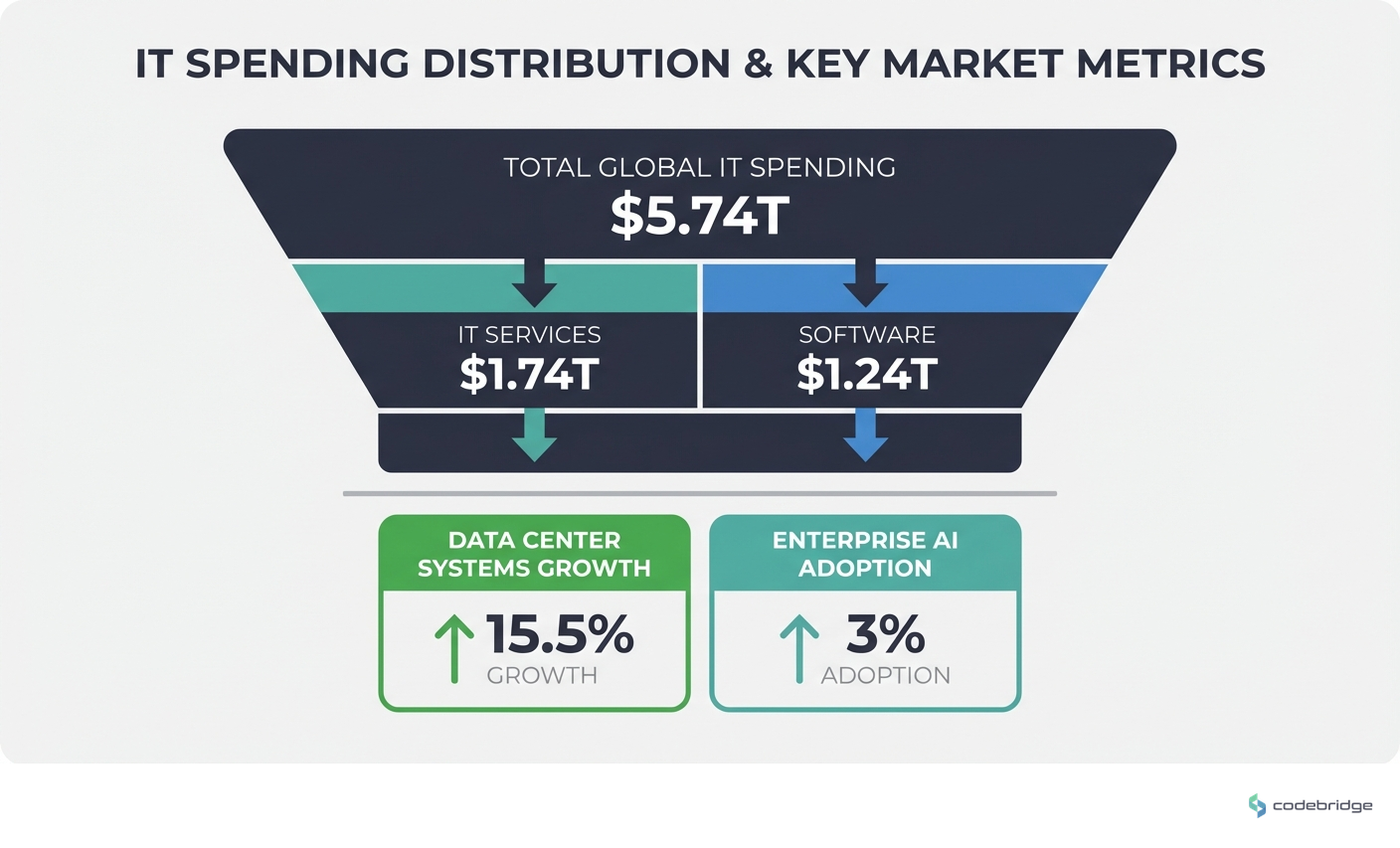

A tech analyst tracking enterprise AI adoption recently made a startling observation that stopped me cold: despite unprecedented capital expenditure projections and wall-to-wall AI coverage, only 3% of US companies are meaningfully using AI in their operations. Meanwhile, investors keep assuming the AI trade is already crowded. The reality? We're only in year three of what's shaping up to be an eight-to-ten-year infrastructure buildout,and most technology leaders are watching from the sidelines, unsure when to make their move.

If you're a tech professional feeling the pressure to "do something with AI" while simultaneously wondering if you've already missed the window, you're not alone. The timing paradox,feeling simultaneously too late and too early,is paralyzing decision-making across the industry.

KEY TAKEAWAYS

We're in early innings, not late game,only 3% of US companies are meaningfully using AI despite massive infrastructure investment.

IT spending is accelerating, not contracting,hitting $5.74 trillion in 2025 with 9.3% annual growth, adding $500B every year.

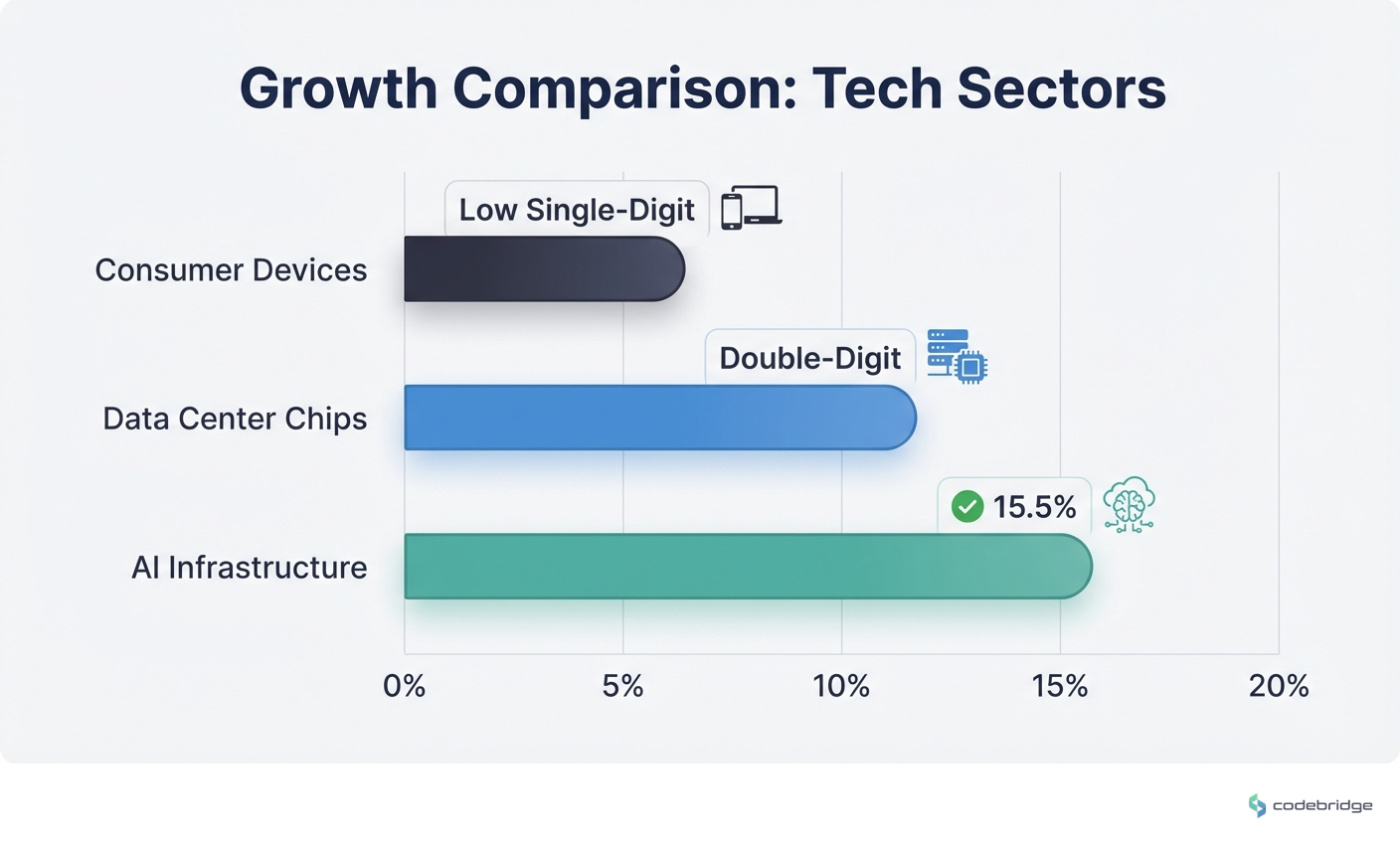

Data center systems lead the charge,15.5% growth outpaces every other tech segment as AI infrastructure scales.

Short-term AI transformation expectations are overblown,supply-side infrastructure is prioritized over widespread adoption.

The window for strategic positioning is now,enterprise spending patterns, not hype cycles, should drive your infrastructure decisions.

The Hidden Problem: Misreading the Market Signals

Here's what's actually happening beneath the headlines: global IT spending hit a record $5.74 trillion in 2025, growing at 9.3% annually. That's not a market in contraction,it's a market in transformation. But the transformation isn't happening where most people expect.

The counter-intuitive insight that's catching executives off-guard: generative AI isn't delivering the massive short-term business transformation everyone predicted. According to the Enaks Tech Industry Outlook 2025, businesses are prioritizing supply-side infrastructure over widespread adoption. Translation: companies are building the pipes, not turning on the water. This creates a specific window of opportunity,and a specific set of risks for those who misread the timing.

Meanwhile, another signal is being completely misinterpreted. Tech layoffs made constant headlines, leading many to assume industry contraction. But the Deloitte 2025 Technology Industry Outlook reveals the opposite: the layoff trend slowed in 2024 while IT spending grew 9.3% in 2025, with double-digit gains in data centers and software. The industry isn't shrinking,it's restructuring around AI infrastructure.

Where the Money Is Actually Flowing

Understanding the capital allocation patterns reveals where strategic opportunities exist. The flow of investment across technology segments tells a clear story about where the industry is placing its bets.

The following diagram illustrates how IT spending distributes across major technology segments:

Data center systems are growing at 15.5%,the fastest rate across all tech sectors,driven primarily by server sales for AI infrastructure. Software follows at 14% growth, hitting $1.24 trillion globally. These aren't incremental gains; they're structural shifts in how technology investment flows.

"Software and IT services are a large driver of IT growth." Spending on these segments is expected to be on AI-related projects, including email and authoring.

John-David Lovelock, VP Analyst at Gartner

The broader information technology market reached $9.61 trillion in 2025, with projections showing an 8.2% CAGR pushing it to $13.17 trillion by 2029. This growth is being driven by tech update, IoT adoption, and,critically,cybersecurity and cloud computing infrastructure.

The Pattern: What Successful Teams Do Differently

The Reddit discussion on AI infrastructure investment patterns surfaced a crucial insight that separates successful technology teams from those caught flat-footed. The analyst tracking these patterns noted that investors consistently underestimate the AI buildout scope, with only 3% of US companies meaningfully using AI despite massive capital expenditure projections.

"The biggest mistake investors continue to make is that they feel the AI trade is already crowded." In fact, it's the complete opposite, with the market only in year three of an eight-to-ten-year buildout.

Tech analyst observation, Reddit r/NvidiaStock

This insight applies directly to technology decision-making: enterprise AI adoption is still in early innings. The teams getting this right are focusing on actual enterprise spending patterns rather than hype cycles when evaluating AI infrastructure investments. They're not asking "Is AI overhyped?" They're asking "Where is enterprise money actually flowing, and how do we position for that?"

The lesson from successful teams: track actual enterprise spending patterns, not media coverage. The 3% adoption rate means 97% of the market is still making infrastructure decisions,your timing isn't late, it's strategic.

The Data Explosion Factor

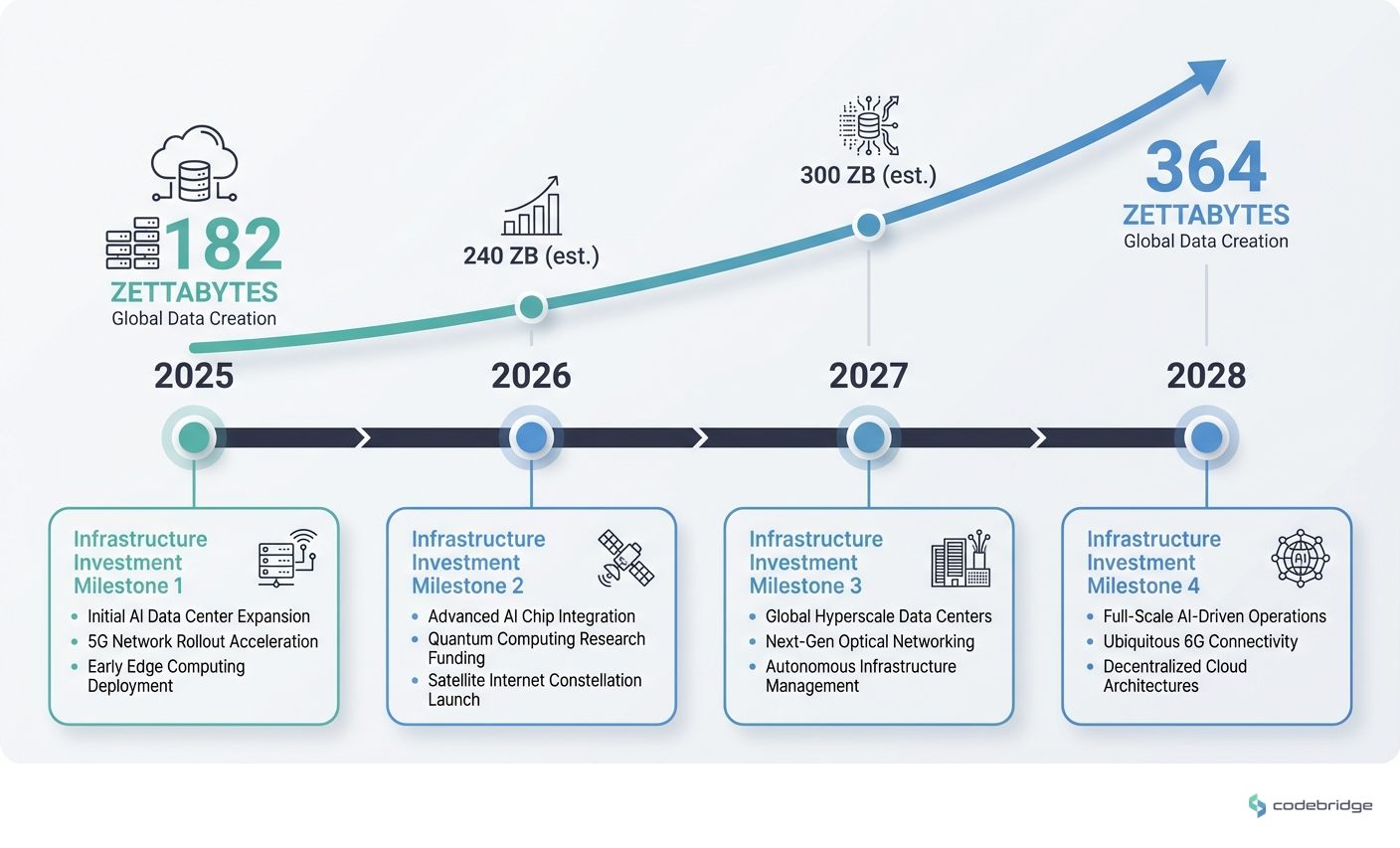

There's another force multiplier that's easy to overlook: global data creation is exploding. According to Workday's analysis, data creation hit 182 zettabytes in 2025,and it's projected to double to 364 zettabytes by 2028. This isn't gradual growth; it's exponential acceleration driven by GenAI and IoT proliferation.

This timeline shows the projected data explosion and its infrastructure implications:

This data explosion creates cascading demand for storage, analytics, and processing infrastructure. It's why 64% of companies are planning to increase IT budgets despite macroeconomic challenges,they're not spending on nice-to-haves, they're spending on infrastructure that their business operations will require.

The Industrial Shift: Beyond Consumer Devices

Another pattern worth noting: industrial applications of advanced computing are surpassing consumer devices. Communication and data center chips are outpacing PC and smartphone sales in 2025, driven by AI chip demand. The Deloitte outlook projects low single-digit growth in PCs versus double-digit growth in data center chips.

This shift has implications for technology professionals across the stack. The infrastructure you're building for, the skills you're developing, and the partnerships you're forming should account for this industrial reorientation. Consumer-facing optimization is still valuable, but the growth frontier is in industrial and enterprise infrastructure.

The comparison below shows where growth is concentrated versus where it's stagnating:

A Framework for Strategic Positioning

Given these patterns, here's how technology professionals can position themselves and their organizations for what's coming:

1. Track Enterprise Spending, Not Headlines

Media coverage of AI is disconnected from actual enterprise adoption patterns. With only 3% of US companies meaningfully using AI, the "crowded trade" narrative is wrong. Use spending data,like the $500 billion being added annually,as your signal, not publication volume.

2. Prioritize Infrastructure Over Applications

The current phase is supply-side infrastructure buildout, not widespread application deployment. This means skills and investments in data center systems, cloud infrastructure, and AI-ready architecture have higher near-term value than consumer-facing AI features.

3. Plan for the Data Doubling

Your storage, analytics, and processing capacity needs to account for data volumes doubling by 2028. This isn't speculative,it's the trajectory we're already on. Architecture decisions made today should assume 2x data loads within three years.

4. Rebalance Consumer vs. Industrial Focus

If your portfolio is heavily weighted toward consumer-facing technology, consider rebalancing toward industrial and enterprise infrastructure. That's where double-digit growth is concentrated.

5. Extend Your Planning Horizon

This is an eight-to-ten-year buildout, not a two-year cycle. Decisions made with a 2027 horizon will be obsolete; decisions made with a 2032 horizon have strategic value. Budget cycles and career planning should reflect this extended timeline.

"Our forecast projects that $500 billion will be added in spending every year For growth rates." With this in mind, IT spending should cross the $7 trillion mark in 2028.

John-David Lovelock, VP Analyst at Gartner

The Window That's Actually Open

Remember the analyst observation that opened this piece,the 3% adoption rate that seems to contradict all the AI hype? That gap between infrastructure investment and actual enterprise adoption represents the current window. Companies are building capacity they haven't yet filled. Skills are being developed for systems that aren't yet deployed at scale. Partnerships are forming around capabilities that will mature over the next five to seven years.

The technology professionals who recognize this timing,who see that we're in year three of an eight-to-ten-year buildout, not the late innings of a played-out trend,have a strategic advantage. Not because they're smarter, but because they're reading the spending data rather than the headlines.

The $5.74 trillion being spent this year isn't the peak. It's the foundation for the $7 trillion that's coming by 2028. The question isn't whether to engage with this buildout,it's how to position yourself and your organization for the next phase.

Evaluating your AI infrastructure readiness?

Schedule a technical assessment to identify where your stack aligns with enterprise spending patterns.

Diagnostic Checklist: Are You Positioned for the AI Infrastructure Buildout?

Your IT budget planning horizon extends to 2030 or beyond, not just the next fiscal year

You can articulate how your infrastructure handles 2x current data volumes

Your team has skills in data center systems, not just application development

You track enterprise IT spending reports (Gartner, Deloitte) as decision inputs

Your AI strategy distinguishes between infrastructure buildout and application deployment phases

You've evaluated industrial/enterprise use cases, not just consumer-facing features

Your vendor relationships include data center and cloud infrastructure providers

You can identify where the 15.5% data center growth creates opportunities for your organization

REFERENCES